Invoicing is an essential part of running a successful business. Generating, tracking, and sending invoices ensures that businesses get paid for their products and services. However, managing invoices manually can be a time-consuming process that takes up valuable resources. That's why many businesses are turning to automated invoicing systems like Wave, PaySimple, and Duetella to streamline their billing process.

Here are some of the benefits of automating your invoicing process:

Improved Accuracy

When invoices are generated and sent manually, there's a higher risk of errors. Typos, incorrect pricing, and other mistakes can add up and cause problems down the line. With automated invoicing, businesses can reduce the chance of errors by setting up templates with pre-filled information and ensuring that all calculations are accurate. This helps to avoid disputes with customers and saves time in rectifying errors.

Increased Efficiency

Perhaps the most significant benefit of invoicing automation is the time it saves. Without the need to manually generate invoices, businesses can free up valuable time to focus on other tasks. Automated systems provide businesses with the ability to generate professional-looking invoices with just a few clicks. The system can also email the invoice to the customer, so businesses don't have to spend time drafting and sending emails.

Automatic Payment Reminders

One of the most significant challenges of invoicing is getting customers to pay on time. Sending reminders to customers for payment can be time-consuming and awkward. Invoicing automation can help businesses stay on top of their payment collection by enabling the automatic sending of payment reminders to customers. This eliminates the need to track down customers manually or send awkward reminders.

Real-Time Payment

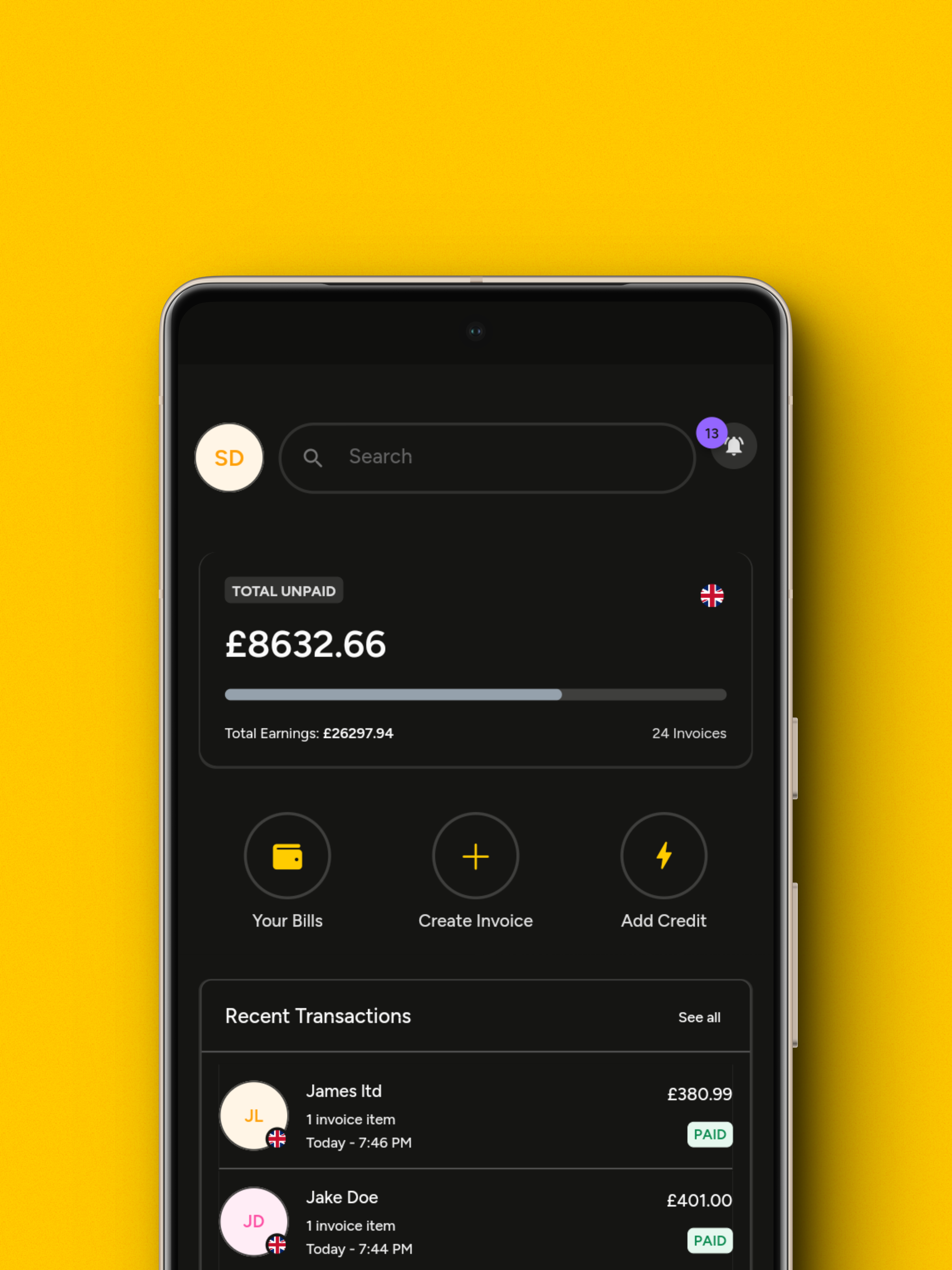

Tracking Automated invoicing systems can track the payment status of each invoice, providing businesses with up-to-date information on what payments have been received. This makes it easy to follow up with customers who haven't paid and helps businesses to anticipate cash flow. Additionally, the real-time tracking feature helps businesses to forecast their revenue more accurately and plan their resources accordingly.

Flexible Payment Options

With automated invoicing systems like Duetella, businesses can accept payments through various modes like Stripe or direct to bank payments. This flexibility in payment options makes it easier for customers to pay and helps businesses to receive funds more quickly. Duetella's app also enables customers to make mobile instalment payments, making it easy to process payments while on the move.

Competitive Pricing

Numerous automated invoicing systems, such as Duetella, are revolutionizing the industry with their competitive pricing. Duetella provides a 30-day trial period, allowing businesses to explore its services before committing. Following the trial, businesses can opt for either a starter plan or a growth plan, both of which are competitively priced and packed with features to streamline the invoicing process. Moreover, Duetella imposes a transaction fee of only 0.60 pence + Stripe fee per credit card transaction, often undercutting other payment processing solutions.

In conclusion, automating your invoicing process can save time, improve accuracy, and provide businesses with a range of useful features. Tools like Wave, PaySimple, and Duetella are designed to help businesses streamline their invoicing process, making it easier to get paid and manage their finances. By adopting an automated invoicing system, businesses can free up valuable time to focus on other aspects of their business. If you haven't already, it's time to consider switching to an automated invoicing system and experience the benefits.